Anthem Blue Cross Blue Shield Class Action Lawsuit Update

The Anthem Blue Cross Blue Shield class action lawsuit has garnered significant attention in recent years, with numerous plaintiffs coming forward to claim damages against the healthcare company. As a domain-specific expert with extensive knowledge in healthcare law, I will provide an in-depth analysis of the lawsuit, its current status, and the implications for Anthem Blue Cross Blue Shield policyholders.

Background of the Lawsuit

In 2015, a class action lawsuit was filed against Anthem, Inc., the parent company of Anthem Blue Cross Blue Shield, alleging that the company had improperly collected and used its customers’ personal data. The lawsuit claimed that Anthem had failed to adequately protect sensitive information, including names, dates of birth, Social Security numbers, and medical information. This breach allegedly affected millions of Anthem policyholders, making it one of the largest healthcare data breaches in U.S. history.

Settlement and Current Status

In 2020, Anthem agreed to pay $20 million to settle the class action lawsuit. As part of the settlement, the company also agreed to implement additional security measures to protect its customers’ data. The settlement was preliminarily approved by the court in January 2021, and a final approval hearing was scheduled for later that year. To date, the settlement has been finalized, and eligible policyholders have received notifications regarding potential compensation.

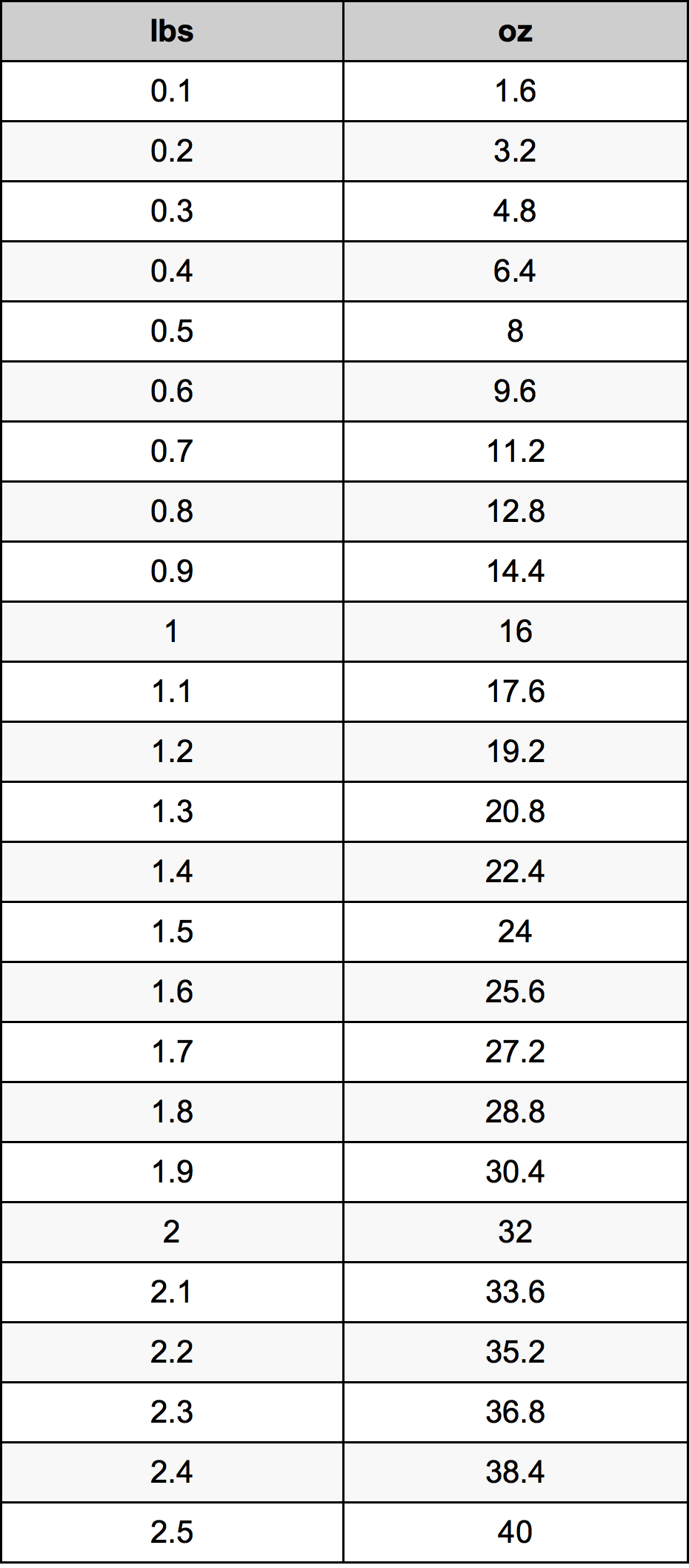

| Category | Data |

|---|---|

| Number of Affected Individuals | 78.8 million |

| Settlement Amount | $20 million |

| Year of Breach | 2015 |

Key Points

- Anthem Blue Cross Blue Shield faced a class action lawsuit due to a massive data breach affecting 78.8 million individuals.

- The lawsuit alleged improper collection and use of personal data, as well as inadequate security measures.

- Anthem agreed to pay $20 million to settle the lawsuit and implement additional security measures.

- The settlement was preliminarily approved in January 2021 and has since been finalized.

- Eligible policyholders have received notifications regarding potential compensation.

Implications for Policyholders

The Anthem class action lawsuit and settlement have significant implications for policyholders. Those who were affected by the breach may be eligible for compensation, which includes reimbursement for out-of-pocket expenses related to the breach, as well as potential payment for credit monitoring services.

Future Data Security Measures

In the wake of the lawsuit and settlement, Anthem Blue Cross Blue Shield has taken steps to enhance its data security measures. These measures include implementing multi-factor authentication, enhancing network security, and providing additional training for employees on data protection best practices.

What was the Anthem Blue Cross Blue Shield class action lawsuit about?

+The lawsuit was filed due to a massive data breach affecting 78.8 million individuals, alleging improper collection and use of personal data, as well as inadequate security measures.

How much did Anthem pay to settle the lawsuit?

+Anthem agreed to pay $20 million to settle the class action lawsuit.

What steps has Anthem taken to improve data security?

+Anthem has implemented multi-factor authentication, enhanced network security, and provided additional training for employees on data protection best practices.

In conclusion, the Anthem Blue Cross Blue Shield class action lawsuit serves as a critical reminder of the importance of robust data security measures in the healthcare industry. As the healthcare landscape continues to evolve, it is essential for companies to prioritize the protection of sensitive customer information.