Car Note Meaning

When considering the concept of "car note meaning," it's essential to understand the context in which this term is used. A car note, often referred to as a car loan or auto loan, is a type of financing that allows individuals to purchase a vehicle by borrowing money from a lender. The term "car note" is commonly used in the United States and is synonymous with a car loan payment.

Understanding Car Note Payments

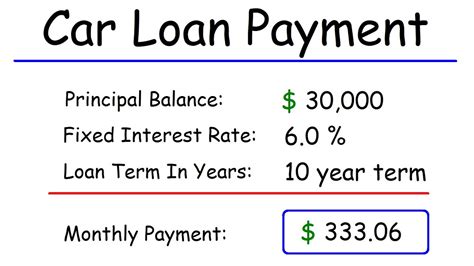

A car note payment typically consists of the principal amount borrowed, plus interest, which is paid back to the lender over a specified period. This period can range from a few years to several years, depending on the loan terms agreed upon by the borrower and the lender. The monthly payment amount is usually fixed and is determined by the total amount borrowed, the interest rate, and the loan term.

Key Components of a Car Note

There are several key components to consider when evaluating a car note: the principal amount, interest rate, loan term, and any additional fees associated with the loan. The principal amount is the initial amount borrowed to purchase the vehicle. The interest rate is the percentage of the principal amount charged by the lender as a fee for borrowing the money. The loan term is the length of time the borrower has to repay the loan.

| Car Note Component | Description |

|---|---|

| Principal Amount | The initial amount borrowed to purchase the vehicle. |

| Interest Rate | The percentage of the principal amount charged by the lender as a fee for borrowing the money. |

| Loan Term | The length of time the borrower has to repay the loan. |

| Additional Fees | Any extra charges associated with the loan, such as origination fees or late payment fees. |

Factors Influencing Car Note Payments

Several factors can influence the amount of a car note payment. The credit score of the borrower plays a significant role, as a higher credit score can qualify the borrower for a lower interest rate, resulting in lower monthly payments. The loan term also affects the payment amount; longer loan terms may result in lower monthly payments but can increase the total cost of the loan over time.

Strategies for Managing Car Note Payments

Managing car note payments effectively is essential to avoid financial strain. One strategy is to make timely payments to avoid late fees and negative impacts on credit scores. Another approach is to consider refinancing the loan if interest rates have dropped since the loan was originated. Additionally, making extra payments towards the principal can help reduce the loan term and the total interest paid over the life of the loan.

Key Points

- Understanding the components of a car note, including principal amount, interest rate, loan term, and additional fees, is crucial for managing car note payments effectively.

- A borrower's credit score significantly influences the interest rate they qualify for, impacting the total cost of the loan.

- Longer loan terms may lower monthly payments but can increase the total cost of the loan.

- Timely payments, refinancing, and making extra payments towards the principal are strategies for managing car note payments efficiently.

- Considering the total cost of the loan over its lifetime, rather than just the monthly payment amount, is vital when negotiating a car note.

In conclusion, understanding the meaning and implications of a car note is essential for individuals looking to purchase a vehicle through financing. By considering the various components of a car note, the factors that influence payments, and strategies for effective management, borrowers can make informed decisions that meet their financial needs and goals.

What is the difference between a car note and a car loan?

+A car note and a car loan are essentially the same thing, with both terms referring to the financing used to purchase a vehicle. The difference lies in the terminology used, with “car note” being more commonly used in certain regions.

How does my credit score affect my car note payments?

+Your credit score plays a significant role in determining the interest rate you qualify for, which in turn affects your car note payments. A higher credit score can qualify you for a lower interest rate, resulting in lower monthly payments.

Can I refinance my car note to get a better interest rate?

+Yes, refinancing your car note is an option if interest rates have dropped since you originated your loan or if your credit score has improved. Refinancing can help you secure a lower interest rate, potentially lowering your monthly payments and the total cost of the loan.