High Income Earner Fsa Limits

As the cost of living continues to rise, high income earners are often faced with the challenge of managing their finances effectively while also taking advantage of tax-advantaged savings options. One such option is the Flexible Spending Account (FSA), which allows individuals to set aside pre-tax dollars for healthcare and dependent care expenses. However, high income earners need to be aware of the FSA limits that apply to their situation, as these limits can impact their ability to maximize their savings.

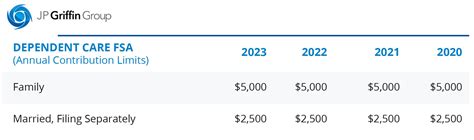

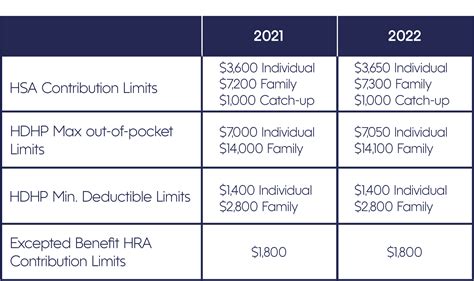

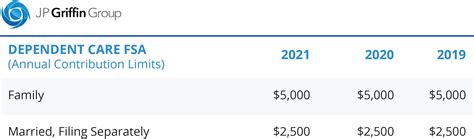

In 2022, the Internal Revenue Service (IRS) announced the FSA limits for the upcoming year, which include a maximum contribution limit of $2,850 for healthcare FSAs and $5,000 for dependent care FSAs. While these limits apply to most individuals, high income earners may be subject to additional restrictions. For example, individuals with incomes above $130,000 may be limited in their ability to deduct medical expenses on their tax return, which could impact their decision to contribute to a healthcare FSA.

Key Points

- The 2022 FSA limits are $2,850 for healthcare FSAs and $5,000 for dependent care FSAs.

- High income earners may be subject to additional restrictions on their FSA contributions.

- Individuals with incomes above $130,000 may be limited in their ability to deduct medical expenses on their tax return.

- FSA contributions can be made on a pre-tax basis, reducing taxable income and lowering tax liability.

- It's essential for high income earners to review their FSA options and plan their contributions carefully to maximize their savings.

Understanding FSA Limits for High Income Earners

High income earners need to understand the FSA limits that apply to their situation and plan their contributions accordingly. While the IRS sets the maximum contribution limits for FSAs, some employers may have more restrictive limits in place. It’s essential for high income earners to review their employer’s FSA plan and understand the rules and regulations that apply to their situation.

In addition to the contribution limits, high income earners should also be aware of the income limits that apply to FSA contributions. For example, individuals with incomes above $214,700 may be subject to a higher tax bracket, which could impact their decision to contribute to an FSA. By understanding these income limits and planning their contributions carefully, high income earners can maximize their savings and reduce their tax liability.

FSA Contribution Strategies for High Income Earners

High income earners can use several strategies to maximize their FSA contributions and reduce their tax liability. One approach is to contribute to a healthcare FSA, which allows individuals to set aside pre-tax dollars for medical expenses. Another approach is to contribute to a dependent care FSA, which allows individuals to set aside pre-tax dollars for childcare or elder care expenses.

It's also essential for high income earners to review their tax situation and plan their FSA contributions accordingly. For example, individuals who are subject to the alternative minimum tax (AMT) may need to adjust their FSA contributions to avoid triggering the AMT. By working with a tax professional and reviewing their FSA options carefully, high income earners can develop a contribution strategy that meets their needs and maximizes their savings.

| FSA Type | Contribution Limit | Income Limit |

|---|---|---|

| Healthcare FSA | $2,850 | No income limit applies |

| Dependent Care FSA | $5,000 | $130,000 or less (joint filers), $65,000 or less (single filers) |

Maximizing FSA Savings for High Income Earners

To maximize their FSA savings, high income earners should review their employer’s FSA plan and understand the rules and regulations that apply to their situation. This includes reviewing the contribution limits, income limits, and any other restrictions that may apply. By developing a comprehensive understanding of their FSA options, high income earners can create a contribution strategy that meets their needs and maximizes their savings.

In addition to reviewing their FSA options, high income earners should also consider their overall tax situation and plan their FSA contributions accordingly. This includes reviewing their tax bracket, deductions, and credits to ensure that they are maximizing their savings and reducing their tax liability. By working with a tax professional and developing a comprehensive tax plan, high income earners can achieve their financial goals and maximize their FSA savings.

FSA Planning Considerations for High Income Earners

When planning their FSA contributions, high income earners should consider several key factors, including their tax situation, income level, and employer’s FSA plan. This includes reviewing their tax bracket, deductions, and credits to ensure that they are maximizing their savings and reducing their tax liability. By developing a comprehensive understanding of these factors, high income earners can create a contribution strategy that meets their needs and maximizes their savings.

It's also essential for high income earners to review their employer's FSA plan and understand the rules and regulations that apply to their situation. This includes reviewing the contribution limits, income limits, and any other restrictions that may apply. By understanding these factors, high income earners can develop a contribution strategy that meets their needs and maximizes their savings.

What are the FSA limits for high income earners in 2022?

+The 2022 FSA limits are $2,850 for healthcare FSAs and $5,000 for dependent care FSAs. However, high income earners may be subject to additional restrictions, such as income limits or tax bracket limitations.

How can high income earners maximize their FSA savings?

+High income earners can maximize their FSA savings by reviewing their employer's FSA plan, understanding the rules and regulations that apply to their situation, and developing a comprehensive contribution strategy. This includes reviewing their tax situation, income level, and employer's FSA plan to ensure that they are maximizing their savings and reducing their tax liability.

What are the income limits for FSA contributions in 2022?

+The income limits for FSA contributions in 2022 are $130,000 or less (joint filers) and $65,000 or less (single filers) for dependent care FSAs. However, there are no income limits for healthcare FSAs.

By understanding the FSA limits and planning their contributions carefully, high income earners can maximize their savings and reduce their tax liability. It’s essential for individuals to review their employer’s FSA plan, understand the rules and regulations that apply to their situation, and develop a comprehensive contribution strategy. By doing so, high income earners can achieve their financial goals and maximize their FSA savings.